More on monetary stimuli

I left a few things out in the last week’s post on monetary stimulus. First of all, let me restate what the Fed and the ECB did.

United States

The Fed proposed purchasing $40bn of mortgage-based securities each month until the labour market improves. They will also continue with existing policies of reinvesting their money from other asset purchases into MBSs, which will increase their holdings of long-term securities by $85bn each month. All this, the Fed hopes, will help put downward pressure on long-term interest rates and support the recovery of the mortgage market. They are now focusing strongly on maintaining their dual mandate; stable prices and low unemployment. That’s why this decision wasn’t a nominal GDP target per se, since the Fed is still sticking to its 2% inflation target. As long as the long run expectations of inflation are intact, the Fed is willing to accept mild inflation now if that would imply an improvement in the labour market.

However, the Fed doesn’t offer a threshold value of the unemployment rate below which it would cease its open market operations. We don’t even know which variable on the labour market they are looking at; the unemployment rate, nominal wages, rise in employment or the E-P ratio? Also, does this mean that the Fed is targeting real values like unemployment, a potentially dangerous decision in terms of future inflation?

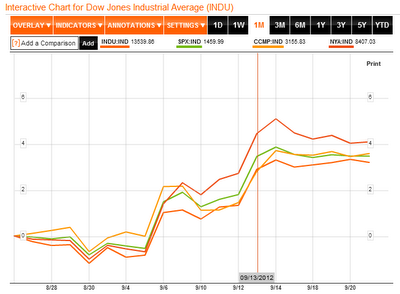

Either way, market monetarists seem to have rejoiced on the news (see Scott Sumner – the loudest and most enthusiastic supporter of the idea, Lars Christensen, David Beckworth, Bill Woolsey, etc.), and so have the US stock markets (see graph below).

|

| Source: Bloomberg. The graph shows Dow Jones Industrial (orange), S&P 500 (green), NASDAQ (yellow) and NYSE composite index (red) and their reactions after September 13th and the Fed's new policy decision. |

Market monetarists do tend to get a lot of credit for such a U-turn approach from the Fed, but most of it goes to Michael Woodford, a prominent monetary economist, and his paper on methods of monetary policy accommodation at the zero-lower bound (I haven’t read it yet, but I intend to).

See his interview for the Washington Post here, where he explains his position. Bottom line, apart from endorsing NDGP targeting his technical paper gives answers to what a central bank can do in times of the zero lower bound. According to him QE (bond buying and increasing the money supply) misses the point. It would be enough for Bernanke simply to say that the Fed is targeting NGDP from now on, since after all, it’s all about expectations. If businesses and consumers expect the interest rates to be low even when the economy starts moving upwards, this means that they will undertake more investments and more loans today. He calls for a policy that would "rely on a combination of commitment to a clear target criterion to guide future decisions about interest-rate policy with immediate policy actions that should stimulate spending immediately without relying too much on expectational channels." Such a clear target criterion would be NGDP targeting, while the immediate policy actions is quantitative easing.

Woodford also calls for a fiscal stimulus to pair it with NGDP targeting, thereby combining two forms of short-run stimuli, where private sector crowding out or inflation from higher government spending could be prevented.

There’s so many things wrong here, but I’ll leave it for the second blog post which will follow shortly. I just can’t accept the argument for either monetary or fiscal stimuli in times when a restructuring of the economy is desperately needed. In the blog so far I've been more focused on fiscal stimuli, primarily because this was the loudest wrong policy that has been advocated so far. Now it's time to turn to monetary stimuli.

Europe

As for the ECB, they pledged to do “whatever it takes” to save the euro (Draghi’s speech from July 2012), which means buying sovereign debt on secondary markets via the bailout mechanism (details of his intentions from a speech in early September 2012). The reaction of Spanish and Italian 10-year bond yields was swift having them fall from 6.8 (Spain) and 5.7 (Italy) to 5.6 and 5 respectfully (see graph). Not only that, but after the announcements equity markets soared, CDS spreads have tightened, while the euro grew stronger.

In addition to that on September 12th the German constitutional court allowed Germany to increase its participation in the European Stability Mechanism (ESM), giving a final boost in confidence for the Eurozone recovery.

|

| Source: Bloomberg. Spanish (orange) and Italian (green) 10-year bond yields - the reaction to the ECB's announcement of unlimited bond buying. |

The credibility of the ECB should be enough to buy peripheral eurozone countries even more time, just as they did back in December 2011 and previous to that in August 2011. Reminiscing on that, a year has gone by since the ECB (then under Thrichet) has helped Italian and Spanish governments to reach their austerity targets and give them more time to initiate reforms. However, the reforms didn’t start until, what a surprise, the change of governments in both Italy and Spain.

Now the new mechanism called Outright Monetary Transactions (OMT) is supposed to yield different results. “Insanity is doing the same thing, over and over again, and expecting different results.” said a wise man once. However the difference is that these bond purchases will be unlimited. This means that ECB will make sure that Spanish and Italian bond yields stay low long enough, at least until the effects from structural reforms in these countries, if any, don’t kick in. Essentially this means that the ECB has finally become the lender of last resort to governments, a controversial solution to the Eurozone crisis that was rightly opposed by Germany in fears of moral hazard.

Is there an effect on confidence?

The argument of the monetary stimulus initiated by the Fed and the ECB (both in different but similar forms) is that it increases business and investor confidence. This is done through expectations of favourable future central bank policies which should induce consumers and investors to spend more money now. However as I've shown back in April, and later in August, similar ECB policies didn’t result in an increase of neither business nor consumer confidence. And this makes perfect sense. The businesses and the consumers haven’t felt the ECB’s policy effects on their pockets. The only ones who did were banks.

And here arises another crucial problem. As I’ve pointed out many times before the biggest beneficiaries of monetary stimuli were banks who ended up expanding their balance sheets, in times when this wasn’t economically favourable or suggested to them. However this massive expansion of their assets hasn’t been allocated to the real sector at all. The same effect was with the EUR 100bn bailout to Spanish banks, which I have predicted to be senseless and worthless back in June. The money was hoarded to cover the losses on bad loans mostly by zombie banks.

Bloomberg made an excellent analysis of this issue:

"European banks pledged last year to cut more than $1.2 trillion of assets to help them weather the sovereign-debt crisis. Since then they’ve grown only fatter. ... They have Mario Draghi to thank. The ECB president’s decision nine months ago to provide more than 1 trillion euros of three-year loans to banks eased the pressure to sell assets at depressed prices. The infusion, designed to encourage firms to lend, succeeded in averting a short-term credit crunch by reducing their reliance on markets for funding. It also may be making European lenders dependent on more central-bank aid." Europe Banks Fail to Cut as Draghi Loans Defer Deleverage, Bloomberg, 18th September 2012

HT: Protesilaos Stavrou.

This is normal and expected behaviour from banks in terms of why they hold on liquidity. As Brad DeLong pointed out back in April (a quote I referred to before):

"The ECB cannot induce banks to make more loans and fund more investment and consumption spending by swapping bonds for reserves as long as the value of pure liquidity is zero and reserves are as good as – nay, better than – short-term bonds."

That’s why for an increase in business confidence I persistently favour structural reforms over any form of short-run stimulus. The causal relationship couldn’t be more clear when businesses are allowed to grow – they are the ones who gain first in confidence (proven by the latest Alesina paper during recoveries), and pull with them consumer confidence by hiring more people and increasing their disposable income. There is no better and more efficient way to increase consumption than via increasing the disposable income of consumers – this can be done in two ways; lowering personal income taxes and creating incentives for the private sector to create jobs.

QE3 is again misallocating resources towards housing

Finally, asset purchases designed by the Fed will be dangerous as they attempt to encourage the public to buy more houses and take on more mortgages. Bernanke confirmed it himself, the QE3 is supposed to lower interest rates on mortgage loans in order to induce more mortgage lending.

I can’t believe that this is happening again. After the misallocation caused by the Fed’s recourse rule made it obvious why creating an artificial demand for housing or mortgage-based securities is dead wrong, the Fed is once again focused on credit allocation policies that seem to be a quick way to combat a recession. Remember that Greenspan in 2001 encouraged mortgage purchases by making banks fill up their balance sheets with MBSs, thereby creating an artificial demand for mortgage loans, and lowering lending standards for those types of loans. Coincidentally, the recourse rule was given effect in 2001. The consequences were dire, but in my opinion necessary in order to reform the unsustainable system. Problem is no one listens, mistakes are being repeated, and quick fixes are wanted to restore old equilibria.

This is something that the market monetarists, and anyone with common sense for that matter, strictly oppose.

this was very interesting but you forgot to mention great inflationary pressures created this way by the Fed and the ECB. I mean when I look at rapidly expanded balance sheets of the Fed or BoE, or the enormously increased money supply, I can't help at wonder what will happen when this bubble bursts and will it initiate hyperinflation?

ReplyDeleteCharlie is correct. We saw an immediate weakening of the dollar after endless QE was announced and a surge in commodity prices. This has to cause interest rates to rise over time for the risk premium. I have no confidence that this policy will work.

ReplyDeleteThe big problem is not hyperinflation because the Fed will stop QE if we get any inflation. The problem is thousands of Banks now loaded with massive cash reserves. If we get a slight economic upturn then inflation will increase no matter what the Fed does, and that will cause debt service on our incredible debt to mushroom.

As for Europe, I would give what they are doing a chance of working only so long as the PIIGS are not still creating huge deficits. I do not have the information on their current fiscal condition. But if public debt is still increasing at a fast rate, then I see no way this strategy will work. It will only prolong and deepen the problem.

I think the effect on confidence isn't suppose to be immediate, but over the medium run. In that sense we are still waiting to see the full effects on confidence from earlier ECB policies, and especially from the new ones.

ReplyDeleteNeither the Fed nor the ECB can get us completely out of the gutter, but they can help buy time for the rest of the economy. And I personally think they are doing a good job.

@Charlie - perhaps it won't lead to hyperinflation but I see what you're aiming at. In fact, Kyle gave you a good response in recognizing the real problem of what happens when banks release the money into the system.

ReplyDeleteOn that perspective, I'm much more worried of a potential new bubble,than I am of inflation. Cause that's how the previous one started. @John - so it isn't about confidence, it's an open threat of a new housing bubble.

@Kyle, as for Europe, their deficits aren't big as before, but they still exist. However the problem is how they choose to cut the deficit, and this is still done via an increased taxation burden, not through an expenditure based approach.